Update: What’s Going on With Commercial Real Estate Interest Rates?

11/10/2025 5:01:40 AM

Interest rates remain a central concern for commercial real estate (CRE) owners and investors as the Federal Reserve (the “Fed”) responds to evolving economic conditions. Since my last update in February 2025, the market environment has shifted and the relationship between the Federal Funds Rate and benchmarks like the 5-Year U.S. Treasury continues to challenge conventional wisdom.

New to this topic? Start with my earlier post: What’s Going on with Commercial Real Estate Interest Rates?!

Fed Moves vs Treasury Yields

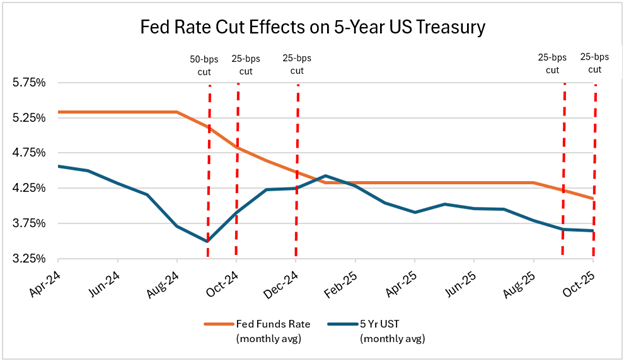

Historically, the expectation has been that when the Fed lowers its rate, Treasury yields will follow. As the chart below shows, that isn’t always the case. In 2024, the Fed reduced its rate by a total of 100 bps over three meetings (September, October, December). The 5-Year U.S. Treasury yield declined ahead of these cuts (reflecting market anticipation), then rose and stabilized between September and January 2025 as market participants reassessed broader economic signals.

Effective Fed Funds vs. 5-Year U.S. Treasury

Effective Fed Funds average October rate is from October 1st - 30th from treasury.gov

From December 2024 through August 2025, the Fed held rates steady amid ongoing uncertainty around tariffs and inflation, which continue to remain above the Fed’s 2% target. However, during this same time period, the 5-Year treasury began to edge lower again, as in 2024 (though less pronounced). Finally, in September and October 2025, the Fed implemented another two 25-bps cuts. If the pattern holds, further rate cuts in late 2025 may not result in significant decreases in the 5-Year Treasury yield – but hopefully, that will not be the result this time.

Market Outlook in Late 2025 and Beyond

After the second consecutive cut in October, officials and analysts are split on whether to cut again in December; under current forecasts, most do not anticipate additional reductions in 2026.

What this could mean for CRE:

- Refinancing: Still challenging for loans originated at much lower rates.

- New transactions: Potentially improving as borrowing costs stabilize and become more predictable.

If you’re considering a purchase or refinance in late 2025 or 2026, keep a close eye on the Federal Funds Rate and Treasury yields, and more importantly, how your lender prices the 5-year portion of the curve into your term sheet.

Plan Ahead with Kearny Bank

If you have questions about how these moves affect your specific property, loan structure, or timing, our Commercial Lending team can help you translate market shifts into next steps.

Sources (for further reading):

After rate cut in Oct

Resource Center | U.S. Department of the Treasury

Effective Federal Funds Rate (Market Daily) - United States…

Future Fed Rate Cuts ‘Far’ From Certain After Divided Meeting - WSJ

Before rate cut in Oct

Fed Lowers Rates by Quarter-Point, Signals More Cuts Are Likely - WSJ

Spread the word